One of the services that USAA offers is home loans, which are designed to help members purchase or refinance their homes.

MORTGAGE CALCULATOR VA LOAN USAA FULL

You must repay your mortgage in full by the end of it.

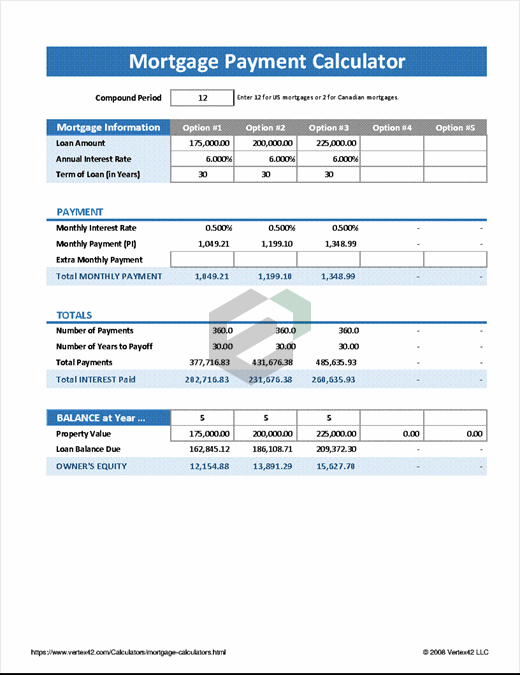

This is the amount you cover yourself when purchasing. When you make a purchase, consider that USAA may require a down payment of 20% of the property's value. This will be the property's price you are buying. It allows you to calculate the USAA mortgage with the property taxes on your loan, private mortgage insurance, and additional costs, like an origination fee or a real estate agent commission. How much will the property cost meĪ mortgage calculator with additional features. You can choose the date of your repayment and the amount you want to pay. If you enter the rate not corresponding to the US ranges, you will see the notification. By default, it is filled with the average interest rate in your region. Our calculator considers your area's mortgage calculations. The maximum USAA mortgage loan term is 30 years.

Your mortgage loan life by the end of which you must repay the debt. Make sure you are within the loan amount limits when applying. This is the sum you need to cover the home purchase without a down payment. To calculate a USAA mortgage, you will need the following: It is useful if you want to lower the overpayment on your home loan. You can calculate your mortgage and see the change in the debt amount if you make an early repayment. Mortgage calculator with early repayment. Differentiated payment schedules allow you to save on interest. A differentiated payment schedule reduces the monthly payment amounts gradually as you pay the body of your loan first. Annuity payments will be preferable, as you will pay the same amounts throughout the entire loan term. If you enter the rate not corresponding to the US interest rate range, you will see the notification. By default, the field is filled with the average interest rate in your region. The loan life you take the mortgage for the end of which your mortgage loan must be paid off. It lowers the loan amount you need to borrow. This is the property's price you are buying.

You may need to enter the mortgage type or interest rate if there are many mortgage types on one page. You fill out the loan amount, loan term, and repayment type. This is a basic version of the mortgage calculator.

MORTGAGE CALCULATOR VA LOAN USAA HOW TO

How to use a USAA mortgage calculator on Finanso Option 1. This can help you make a more informed decision about whether a particular home or loan option is right for you. By estimating your monthly mortgage payment, closing costs, and other expenses, you can get a clearer picture of your overall financial commitment. You can also input your desired insurance coverage to get an estimate of your monthly insurance premium. By inputting your property's location and value, you can get an estimate of your property taxes. A USAA mortgage calculator can help you estimate these costs as well. In addition to your mortgage payment, you will also be responsible for property taxes and homeowners insurance. By inputting information such as the loan amount, property value, and location, you can get an estimate of the closing costs you can expect to pay. A USAA mortgage calculator can help you estimate the closing costs associated with your loan. Closing costs can be a significant expense when purchasing or refinancing a home. This helps you determine which loan option is the most cost effective for your specific financial situation. By inputting the details of multiple loan options, you can compare the monthly payments, interest rates, and other costs associated with each option. The USAA mortgage calculator on Finanso can help you compare different loan options. You can determine if a particular loan option is affordable for your budget. By inputting information such as the loan amount, annual percentage rate, and term of the loan, you can get an accurate estimate of how much your monthly mortgage payment will be. There are several reasons you need a USAA mortgage calculator: If you are in the process of purchasing a home or refinancing your mortgage, a USAA mortgage calculator can be an invaluable tool in helping you understand and plan for the costs associated with your loan.

0 kommentar(er)

0 kommentar(er)